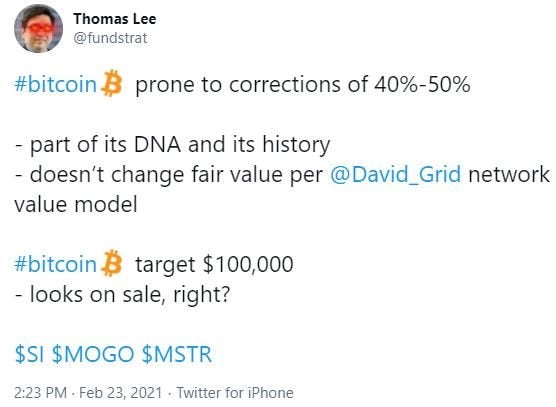

- Bitcoin’s recent correction of more than 20% is “part of its DNA and its history,” Fundstrat’s Tom Lee said in a tweet on Tuesday.

- Lee reiterated his $100,000 price target on bitcoin, arguing that the sell-off doesn’t change fair value.

- Bitcoin “looks on sale,” Lee Tweeted.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell

The more than 20% sell-off in bitcoin this week shouldn’t be a surprise to investors familiar with the cryptocurrency, according to Fundstrat’s Tom Lee.

In a tweet on Tuesday, Lee said bitcoin is prone to corrections of 40%-50%, adding that the sizable corrections are “part of its DNA and its history.”

After topping out at more than $58,000 over the weekend and eclipsing $1 trillion in market value, bitcoin sold-off to a low of $45,000 on Tuesday amid risk-off sentiment among investors due to concerns of rising interest rates.

But the decline in bitcoin “doesn’t change fair value” for the cryptocurrency, Lee said before reiterating his $100,000 price target. A surge in bitcoin to $100,000 would represent potential upside of 117% from Tuesday afternoon levels.

Lee’s price target for bitcoin is predicated on his view that 2021 represents a similar setup to 2017 for the cryptocurrency: a parabolic rally following a halvening event. A halvening in bitcoin is when the reward for miners completing problems on the bitcoin blockchain is cut in half. Bitcoin completed a halvening event last year.

"Looks on sale, right?" Lee asked.